|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding 401k Loan for Home Refinance: A Comparative GuideRefinancing your home can be a strategic financial move, and one option available is using a 401k loan. This article explores the intricacies of using a 401k loan for home refinance, compares it to other options, and offers valuable insights to help you make an informed decision. What is a 401k Loan?A 401k loan allows you to borrow money from your retirement savings account. This option can be appealing because it uses your funds and doesn't require a credit check. However, it comes with its own set of pros and cons. Benefits of Using a 401k Loan

Drawbacks to Consider

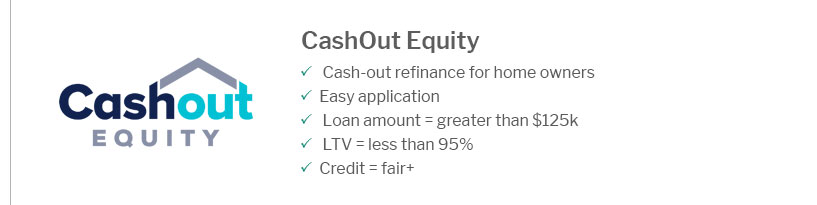

Comparing 401k Loan to Other Refinance OptionsThere are several other refinancing options to consider, such as cash-out refinance, home equity loans, and personal loans. Each has unique benefits and drawbacks. Cash-Out RefinanceThis option allows you to refinance your mortgage for more than you owe and take the difference in cash. It's typically used for large expenses, like home improvements. However, it can result in higher interest rates. Home Equity LoanHome equity loans allow you to borrow against the equity in your home. They often offer fixed interest rates, providing predictability in monthly payments. For those considering relocation, understanding the local market is crucial. Explore first time home buyer Arkansas to see how this might impact your decision. Personal LoansPersonal loans can be used for refinancing, but they usually come with higher interest rates compared to home equity loans or cash-out refinancing. They might be a suitable option for those without enough home equity. FAQ

When considering a refinance, it's important to weigh all options carefully. Stay updated on mortgage rates today Colorado to ensure you're getting the best deal possible for your situation. https://www.reddit.com/r/FinancialPlanning/comments/1alr28o/401k_loan_to_pay_down_house_mortgage_to_save_on/

I'm investigating taking a $50k 401k LOAN out of my 401k, total 401k balance $130k, to pay down the principle on my house to save myself from paying interest ... https://meetbeagle.com/resources/post/can-you-refinance-a-401k-loan

The most common option is to take a home-equity loan using your home as collateral, and using the loan proceeds to pay off the 401(k) loan. If you are in the ... https://refi.com/borrowing-from-401k-to-refinance-underwater-mortgage/

Your 401k as a Multiplier. The advantage is that taking a relatively small amount out of your 401k may enable you to refinance a 5-10 times ...

|

|---|